Effect of Capital Adequacy Ratio, Credit Policy, Liquidity Risk and Non-Performing Loan on Financial Distress

DOI:

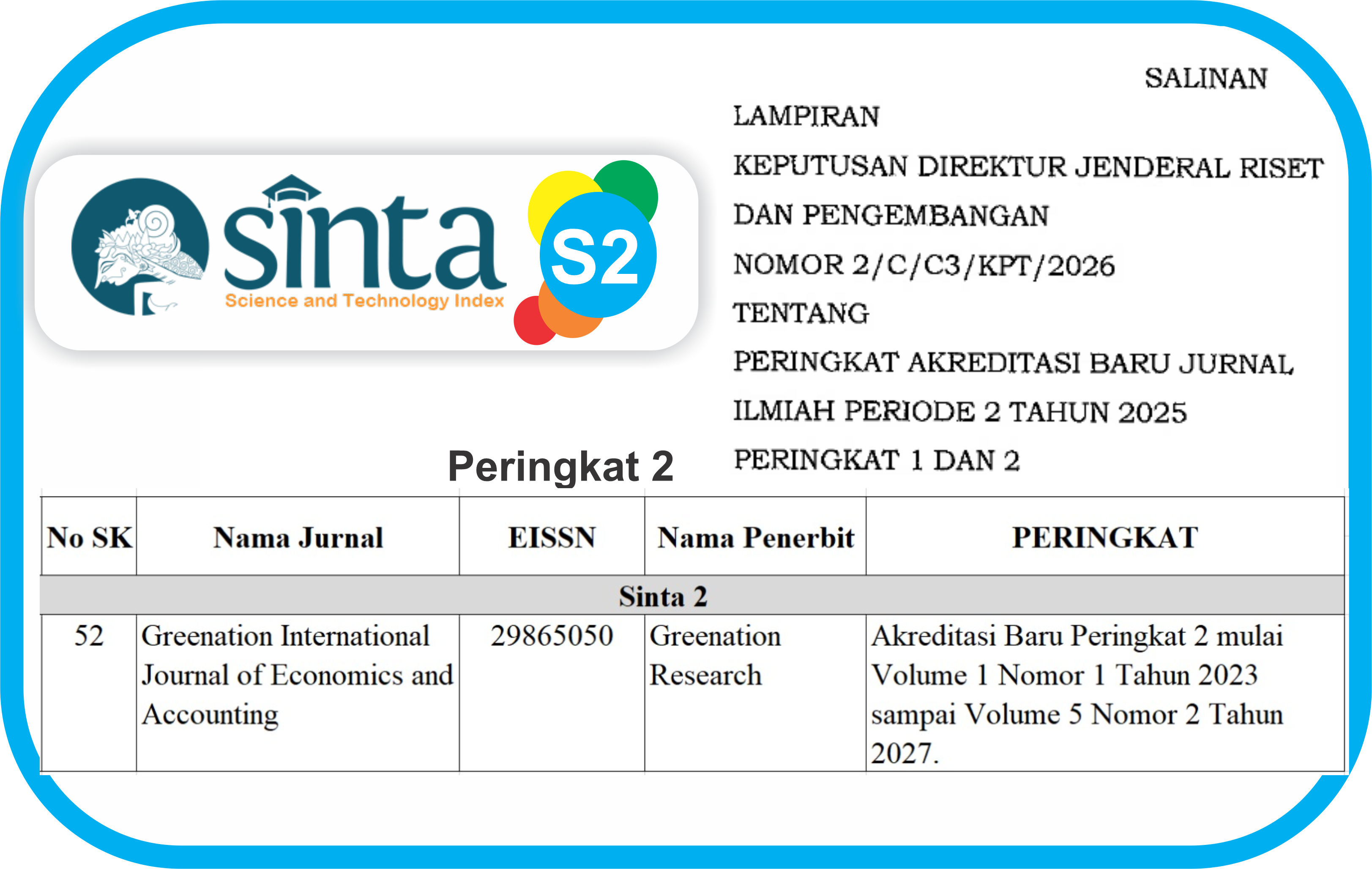

https://doi.org/10.38035/gijea.v2i4.300Keywords:

Financial Distress, Capital Adequacy Ratio, Credit Policy, Liquidity Risk, Non-Performing LoanAbstract

The purpose of this literature research is to build hypotheses regarding the influence between variables which can later be used for further research in financial management. The literature review research article on the effect of Capital Adequacy Ratio, Credit Policy, Liquidity Risk, and Non-Performing Loans on Financial Distress is a scientific literature article within the scope of financial management science. The approach used in this literature review research is descriptive qualitative. The data collection technique uses literature studies or reviews relevant previous articles. The data used in this descriptive qualitative approach comes from previous research that is relevant to this research and comes from academic online media such as Thomson Reuters Journals, Springer, Taylor & Francis, Scopus Emerald, Elsevier, Sage, Web of Science, Sinta Journals, DOAJ, EBSCO, Google Scholar and digital reference books. In previous studies, 1 relevant previous article was used to review each independent variable. The results of this literature review article are: 1) Capital Adequacy Ratio affects Financial Distress; 2) Credit Policy affects Financial Distress; 3) Liquidity Risk affects Financial Distress; and 4) Non-Performing Loan affects Financial Distress.

References

Amin, A. R. S., Syafaruddin, S., Muslim, M., & Adil, M. (2022). Pengaruh Rasio Likuiditas, Rasio Leverage, dan Rasio Aktivitas terhadap Pertumbuhan Laba pada Perusahaan Manufaktur Sub Sektor Makanan dan Minuman yang Terdaftar di Bursa Efek Indonesia. Jurnal Mirai Management, 7(3), 757–761.

Anggari, N. L. S., & Dana, I. M. (2020). The effect of capital adequacy ratio, third party funds, loan to deposit ratio, bank size on profitability in banking companies on IDX. American Journal of Humanities and Social Sciences Research (AJHSSR), 4(12), 334–338.

Budianto, E. W. H., & Dewi, N. D. T. (2022). Pemetaan penelitian rasio Capital Adequacy Ratio (CAR) pada perbankan syariah dan konvensional: studi bibliometrik VOSviewer dan literature review. Journal of Accounting, Finance, Taxation, and Auditing (JAFTA), 4(2).

Budiman, N. T., & Supianto, S. (2020). Penerapan Kebijakan Tentang Prinsip Kehati-Hatian Dalam Pemberian Kredit Perbankan. Widya Yuridika, 3(2), 327. https://doi.org/10.31328/wy.v3i2.1703

Citra Wulandari, A., Oktavia, R., Widiyanti, A., & Indra, A. Z. (2022). Analisis Pengaruh Leverage, Average Collection Period, Sales Growth dan Profitabilitas Terhadap Financial Distress. E-Journal Field of Economics, Business and Entrepreneurship, 1(1), 47–58. https://doi.org/10.23960/efebe.v1i1.17

Dao, B. (2020). Bank capital adequacy ratio and bank performance in Vietnam: A simultaneous equations framework. Journal of Asian Finance, Economics and Business, 7(6), 39–46.

Dewi, N. L. P. A., Endiana, I. D. M., & Arizona, I. P. E. (2019). Pengaruh rasio likuiditas, rasio leverage dan rasio profitabilitas terhadap financial distress pada perusahaan manufaktur. Kumpulan Hasil Riset Mahasiswa Akuntansi (KHARISMA), 1(1).

Egga Pratiwi, D., Hanifah, I., & Affiliation, R. (2024). Perlindungan Hukum Terhadap Perjanjuan Kredit Dengan Menggunakan Jaminan Surat Keputusan Pengangkatan Pegawai Negeri Sipil. IBLAM LAW REVIEW, 4(1), 303–323.

Fadhila, A. H., & Haryanti, P. (2020). Pengaruh Profitabilitas, Islamic Governance Score, Dan Ukuran Bank Terhadap Pengungkapan Islamic Sosial Reporting (Isr) Pada Bank Umum Syariah Di Indonesia. Malia: Jurnal Ekonomi Islam, 11(2), 187–206.

Faisal, A., Hasanah, A., & Adam, A. M. (2021). Pengaruh Fundamental Perusahaan Dan Reaksi Pasar Modal Sebelum Dan Saat Pandemi Covid-19 Terhadap Return Saham (Studi Kasus Jakarta Islamic Index Periode 2016-2020). Jurnal Ekonomi Syariah Teori Dan Terapan, 8(6), 771. https://doi.org/10.20473/vol8iss20216pp771-784

Faisal, M. F. A. (2022). Analisis Perbandingan Model Pendeteksi Financial Distress. Jurnal Riset Terapan Akuntansi, 6(1), 35–43.

Firdaus, I., & Rohdiyarti, M. P. (2021). Pengaruh Harga Saham, Debt To Equity Ratio, Return on Assets, Dan Sales Growth Terhadap Price Book Value (Studi Pada Sektor Pertanian Yang Tercatat Di Bursa Efek Indonesia Periode 2013-2018). Jurnal Ekonomi Manajemen Sistem Informasi, 3(1), 35–51. https://doi.org/10.31933/jemsi.v3i1.674

Gunawan Aji, Maisaroh, D., A’inin Ni’mah, Robiatul Adawiyah, & Amelia Sya. (2023). Pengaruh Rasio Likuiditas, Risiko Kredit, Good Corporate Governance, dan Leverage Terhadap Financial Distress. Jurnal Ekonomi, Bisnis Dan Manajemen, 2(2), 148–158. https://doi.org/10.58192/ebismen.v2i2.813

Hartati, L., Ndoen, W. M., Foenay, C. C., & Rozari, P. E. De. (2010). Analisis kebijakan kredit pada koperasi simpan pinjam (ksp) kopdit harapan sejahtera kelurahan lasiana kota kupang. Glory: JurnalEkonomi&IlmuSosial ANALISIS, 1085–1094.

Hidayat, A., Akbar, G. G., & Salamah, U. (2022). Pengaruh Implementasi Kebijakan Relaksasi Kredit Dan Budaya Organisasi Terhadap Efektivitas Pencapaian Program Perkreditan. Ijd-Demos, 4(2), 842–852. https://doi.org/10.37950/ijd.v4i2.282

Husain, F. (2021). Pengaruh Rasio Likuiditas dan Rasio Profitabilitas terhadap Harga Saham Pada Perusahaan Indeks IDX-30. INOBIS: Jurnal Inovasi Bisnis Dan Manajemen Indonesia, 4(2), 162–175. https://doi.org/10.31842/jurnalinobis.v4i2.175

Hutauruk, M. R., Mansyur, M., Rinaldi, M., & Situru, Y. R. (2021). Financial Distress Pada Perusahaan Yang Terdaftar Di Bursa Efek Indonesia. JPS (Jurnal Perbankan Syariah), 2(2), 237–246. https://doi.org/10.46367/jps.v2i2.381

Ichsan, R. N., & Nasution, L. (2020). Analisis Pengaruh Npl, Car, Bopo Dan Irr Terhadap Pertumbuhan Kinerja Keuangan Bank Yang Terdaftar Di Bursa Efek Indonesia Periode 2011-2015. Moneter: Jurnal Keuangan Dan Perbankan, 8(1), 51–59.

Kristin, M., Leon, F. M., & Purba, Y. E. (2021). Faktor – Faktor Penentu Kebijakan Pembayaran Dividen Pada Industri Non Keuangan di Indonesia dan Australia. Jurnal Bisnis Strategi, 30(2), 101–114. https://doi.org/10.14710/jbs.30.2.101-114

Mardianti, I. V., & Ardini, L. (2020). Pengaruh Tanggung Jawab Sosial Perusahaan, Profitabilitas, Kepemilikan Asing, dan Intensitas Modal terhadap Penghindaran Pajak. Jurnal Ilmu Dan Riset Akuntansi (JIRA), 9(4).

Miswanto, M., Setiawan, A. Y., & Santoso, A. (2022). Analisis Pengaruh Pertumbuhan Penjualan, Struktur Aset, dan Profitabilitas terhadap Struktur Modal. Jurnal Maksipreneur: Manajemen, Koperasi, Dan Entrepreneurship, 11(2), 212–226. https://doi.org/10.30588/jmp.v11i2.945

Ningsih, S., & Dewi, M. W. (2020). Analisis Pengaruh Rasio NPL, BOPO Dan CAR Terhadap Kinerja Keuangan Pada Bank Umum Konvensional Yang Terdaftar Di BEI. Jurnal Akuntansi Dan Pajak, 21(01), 71–78.

Putri, R. (2021). Pengaruh Rasio Keuangan Dalam Memprediksi Financial Distress Pada Bank Umum Syariah. Fidusia?: Jurnal Keuangan Dan Perbankan, 4(2), 159–172. https://doi.org/10.24127/jf.v4i2.651

Romadhani, A., Saifi, M., & Nuzula, N. F. (2020). Pengaruh Profitabilitas, Ukuran Perusahaan Dan Kebijakan Dividen Terhadap Nilai Perusahaan. PROFIT: JURNAL ADMINISTRASI BISNIS, 14(2), 71–81.

Saputra, F., & Mahaputra, M. R. (2022). Relationship of Purchase Interest , Price and Purchase Decisions to IMEI Policy ( Literature Review Study ). Journal of Low Politic and Humanities, 2(2), 71–80.

Sari, L. P. (2019). Pengaruh struktur modal, profitabilitas dan ukuran perusahaan pada nilai perusahaan. STIE Indonesia Banjarmasin.

Shidiq, J. I., & Khairunnisa, K. (2019). Analisis Rasio Likuiditas, Rasio Leverage, Rasio Aktivitas, Dan Rasio Pertumbuhan Terhadap Financial Distress Menggunakan Metode Altman Z-Score Pada Sub Sektor Tekstil Dan Garmen Di BEI Periode 2013-2017. JIM UPB (Jurnal Ilmiah Manajemen Universitas Putera Batam), 7(2), 209–219.

Sholahuddin, M., Pradana, A. N., & Awangrif, H. A. (2020). Pengaruh Profitabilitas, Leverage Dan Kebijakan Deviden Terhadap Nilai Perusahaan (Systemic Literature Review). Proceeding of The URECOL, 37–44.

Sinambela, T., & Marpaung, A. I. (2019). the Influence of Profit and Cash Flow To Predict Financial Distress. Dinasti International Journal of Management Science, 1(2), 191–203. https://doi.org/10.31933/dijms.v1i2.54

Soekapdjo, S. (2020). Peran Sistem Informasi Pemasaran, Kualitas Pelayanan dan Entrepreneurial marketing serta Kepuasan Terhadap Loyalitas Generasi Milenial Berkunjung ke Tempat Wisata. Jurnal Ilmiah Bisnis Dan Ekonomi Asia, 14(1), 35–45. https://doi.org/10.32812/jibeka.v14i1.148

Suhartanto, R. A., Ilat, V., & Budiarso, N. S. (2022). Pengaruh Non Performing Loan, Loan to Deposit Ratio, Return On Asset, dan Capital Adequacy Ratio Terhadap Prediksi Potensi Financial Distress (Studi Empiris Pada Bank BUMN di Indonesia Periode 2014-2021). GOODWILL: Jurnal Riset Akuntansi Dan Auditing, 13(1), 126–140.

Suroso, S. (2022). Analysis of the Effect of Capital Adequacy Ratio (CAR) and Loan to Deposit Ratio (LDR) on the Profits of Go Public Banks in the Indonesia Stock Exchange (IDX) Period 2016 – 2021. Economit Journal: Scientific Journal of Accountancy, Management and Finance, 2(1), 45–53. https://doi.org/10.33258/economit.v2i1.610

Susanto, P. C., Arini, D. U., Yuntina, L., & Panatap, J. (2024). Konsep Penelitian Kuantitatif?: Populasi , Sampel , dan Analisis Data ( Sebuah Tinjauan Pustaka ). Jurnal Ilmu Manajemen, 3(1), 1–12. https://doi.org/https://doi.org/10.38035/jim.v3i1

Syuhada. Putri. (2020). Pengaruh Kinerja Keuangan dan Ukuran Perusahaan Terhadap Financial Distresspada Perusahaan Propertydan Real Estatedi BursaEfek Indonesia. Jurnal Riset Akuntansi Dan Keuangan, 8(2).

Tanjung, Y. S., Widyastuti, T., & Rachbini, W. (2021). The Effect of Capital Structure, Liquidity, Dividend Policy, and Debt Policy on Company Value with Profitability as Moderating Variables in the Jakarta Islamic Index for the 2016-2020 period. Financial Management Studies, 4(1), 85–100. https://jkmk.ppj.unp.ac.id/index.php/fms/article/view/58%0Ahttps://jkmk.ppj.unp.ac.id/index.php/fms/article/download/58/48

Thi Mai Nguyen, L., Le, D., Vu, K. T., & Tran, T. K. (2023). The role of capital structure management in maintaining the financial stability of hotel firms during the pandemic—A global investigation. International Journal of Hospitality Management, 109(August 2022), 103366. https://doi.org/10.1016/j.ijhm.2022.103366

Towhid, A., Shinta Amalina Hazrati Havidz, & Mohammed Ameen Qasem Ahmed Alnawah. (2019). Bank-Specific and Macroeconomic Determinants of Non-Performing Loans of Commercial Banks in Bangladesh. Dinasti International Journal of Management Science, 1(1), 86–101. https://doi.org/10.31933/dijms.v1i1.28

Yusuf, M., Sari, L., Septiano, R., Nuryati, S., Lestari, I. D., Arief, Z., Hernawan, M. A., Nurhayati, S., & Azizah, K. (2022). Financial ratio model and application of good corporate governance to npl with inflation as a moderate variable. Journal of Management Information and Decision Sciences, 25, 1–12.

Zainal, V. R., Widodo, D. S., & Subagja, I. K. (2019). Indonesia Islamic Banking Readiness in Facing the ASEAN Economic Community, in Terms of Islamic Banking Disclosure and Performance Indices. Journal of Economics and Management Sciences, 2(2), p25–p25.

Zulna, E. I. (2022). Analisis Rasio Perputaran Piutang dan Periode Rata-Rata Pengumpulan Piutang Sebagai Dasar Penilaian Efektivitas Kebijakan Kredit PT. ISAM. Indonesian Accounting Literacy Journal, 2(2), 460–467. https://doi.org/10.35313/ialj.v2i2.3172

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Christophorus Indra Wahyu Putra, Adler Haymans Manurung, Nera Marinda Machdar

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright :

Authors who publish their manuscripts in this journal agree to the following conditions:

- Copyright in each article belongs to the author.

- The author acknowledges that the GIJEA has the right to be the first to publish under a Creative Commons Attribution 4.0 International license (Attribution 4.0 International CC BY 4.0).

- Authors can submit articles separately, arrange the non-exclusive distribution of manuscripts that have been published in this journal to other versions (for example, sent to the author's institutional repository, publication in a book, etc.), by acknowledging that the manuscript has been published for the first time at GIJEA.